Burrillville Bank

Chartered in 1818, this bank was created to service the small but growing mill town of Burrillville. It was located “near the Eddy Copper place” close to the village of Mapleville, according to one 19th century account. It was also noted that,

“The vault was hewn from solid rock, and the trap door that covered it could only be lifted by a tackle attached to the ceiling of the counting-room. If burglars had unlocked it, they could not have got at the coin unless they could have found the tackling. It was a safe bank.

“Those who lived near the Smith Academy would not subscribe to the stock because they could not have it at their village. The old settlers assert that it might have done a good business there, as there were many solid men in that vicinity. We will not stop to discuss the probabilities of its success under other circumstances, or to speculate upon the causes or consequences of its embarrassment, but hasten to warn readers not to receive the bills as they have been rejected at the Suffolk. Mutatis mutandis.” — Horace A. Keach, Burrillville; As It Was, And It Is. Providence: Knowles, Anthony & Co., 1856.

The Burrillville Bank failed on April 3, 1832. While the author above obliquely refers to this as “its embarrassment” and offers no more explanation, a description from 1907 completes the story and details the fate of the bank’s last president, John L. Clark:

“John L. Clark was engaged in a brokerage business in the city of Providence, selling lottery tickets. He became involved in the affairs of the Burrillville Bank. The bank was incorporated in 1818. Mr. Clark’s connection with it began in September, 1831, when he was made President. Its circulation was then $2000. Seven months later, in April, 1832, its circulation had increased to $56,000, and it then failed. In March, a month before the failure, Clark removed all the books to Providence and cut from them all leaves bearing entries of bills delivered to himself, but these leaves were afterward recovered. Clark ran away, but was arrested in New York in May, 1832, and brought back. He was tried in March, 1834, and sentenced to pay a fine of $5000 and to stand committed until the fine was paid.

“The General Assembly at the January session (1835) remitted the fine and he was released upon his making an assignment of his property to commissioners who had been elected by the General Assembly to close the affairs of the Burrillville Bank. It took 12 years to finish its labors, but cost only $500, to be divided between three. The principal assets of the bank consisted of notes and indorsements of Francis Y. Carlisle, who was a clerk in the office of Mr. Clark. Long litigation followed with Carlisle which resulted in the commissioners’ obtaining judgment against him for an amount over $100,000. A compromise was finally made with him, he giving bonds to redeem the circulation and pay the other debts against the bank, with the exception of such debts as might be due Clark, he being the only real stockholder.

“Clark committed suicide July 26, 1836. He was then 31 years old. Carlisle continued for two or three years, endeavoring to grasp the business which Clark had left, and in the meantime purchasing the bills of the Burrillville Bank, which he was bound to redeem. He finally left Providence and travelled through the South and West, writing occasional letters to the Journal.” – Providence Typographical Union #33, Printers and Printing in Providence, 1762 – 1907, 1907.

The Suffolk Bank of Mutual Redemption held $18,005 in Burrillville Bank bills after its failure.

On a sidenote: After his arrest in New York, John L. Clark unsuccessfully fought his extradition to Rhode Island. Those court proceedings were later cited as an example of the constitutionality of fugitive slave laws, ie. that the North had a legal obligation to return slaves who had escaped from the South.

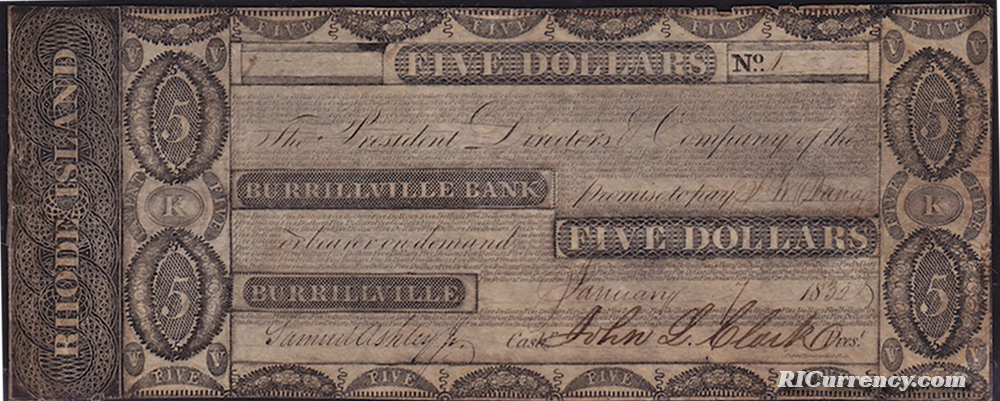

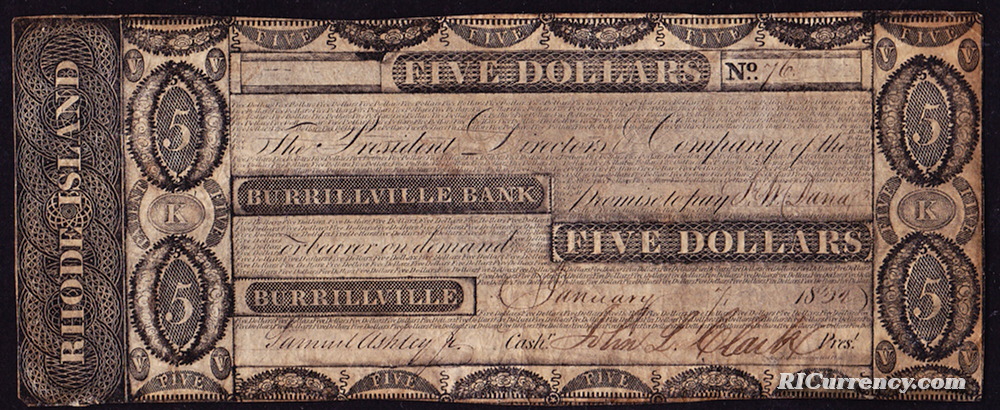

Two of the $5 notes below were signed by Clark.

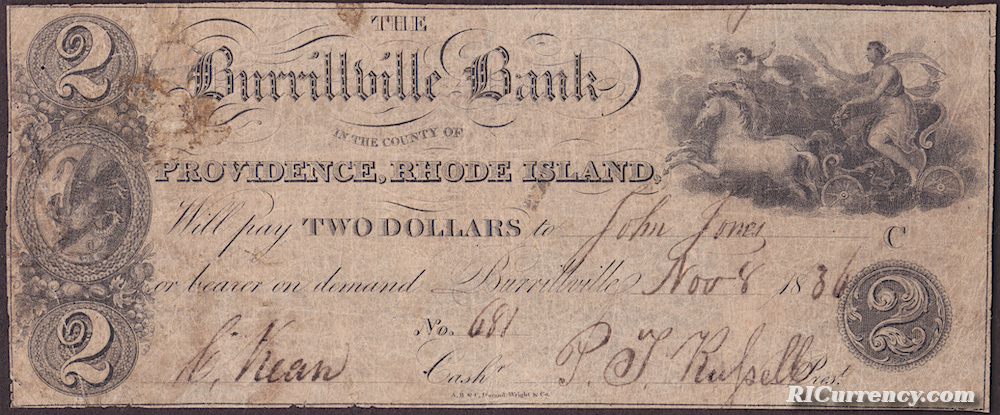

November 8, 1836. Durand 175, Haxby RI-50 G8, Bowers W-RI-140-002-G030