Newport Bank

Incorporated in 1803, the Newport Bank was the city’s third financial institution. It occupied the Rathbun-Gardner-Rivera House at 8 Washington Square, which remains a bank office to this day.

According to historian Howard Kemble Stokes, “By terms of its charter the president and its directors were authorized to organize the Rhode Island Insurance Company, and the latter was to subscribe for one thousand shares of the bank’s stocks. As the par value of the bank’s stock was $60, and the amount of it was $120,000, this subscription amounted to one-half of the total issue of bank stock.”

Early insurance companies were instrumental in protecting the profitability of the sea trade, which could often be unpredictable, so it is not surprising that a bank and insurance company would started together in a port city like Newport.

Yet this combination raises the question: What sort of sea trade was the Newport Bank created to finance?

One of the bank’s founders was William Vernon (1719-1806), an important Revolutionary War figure and prolific slave trader. With his older brother Samuel (1711-1792), William owned a number of ships that engaged in the “triangle trade,” i.e. exchanging rum for slaves, and slaves for molasses, which in turn was used to make rum for the purchase of more slaves. The Vernon brothers acquired their human cargo in Sierra Leone and on Africa’s Gold Cost. These men, women and children were then shipped to Barbados, Jamaica, Cuba, Trinidad and the Dutch Caribbean where they were sold to plantation owners. The Vernons were also the first Newport merchants to sell directly to the Southern colonies. Their vessels made port numerous times in Virginia and South Carolina. Records indicate that the bulk of this human trade took place before the inception of the Newport Bank, between the 1750s and 1790s.

William’s son Samuel Vernon (1757-1834) was appointed the first president of the Rhode Island Insurance Company, highlighting another connection between the family and this business enterprise.

Newport Bank’s first president* was Constant Taber (sometimes spelled Tabor), who served in that position for 23 years. Taber held a number of public offices, including Chief Justice of Rhode Island from 1792 until 1801. In 1801, he was appointed Navy Agent by President Thomas Jefferson and was reappointed in 1810 by President James Madison. In addition, Taber served as Republican Presidential Elector for Rhode Island in 1804, Lieutenant Governor from 1807 to 1808 and State Treasurer from 1808 to 1811. These connections likely helped the bank become the local depository for federal government funds.

Taber also had a history as a slave trader.

In The Transformation of Rhode Island 1790-1860, Peter J.Coleman has noted that Newporters “plunged back into slaving after the Revolution in a desperate attempt to build the town’s shattered economy” and that, “Between 1803 and 1807 Newport merchants shipped almost thirty-five hundred slaves to Charlestown, about six times the number shipped by either Providence or Warren firms.”

Records show that Taber owned various types of ships during these years, though further research will be needed to verify that he and the Vernon family continued to trade slaves while connected to the Newport Bank and whether financing that trade was the original intention in founding the organization.** Nevertheless, the Vernon-Taber connection is an inauspicious one.

After Taber’s death in 1826, he was replaced briefly by John Coggehall.

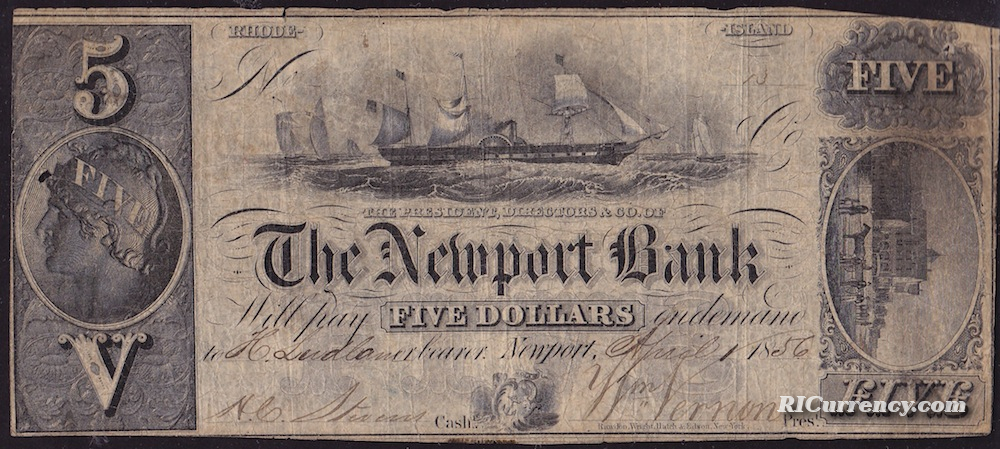

Vernon’s son Samuel (who, as previously mentioned, also ran the insurance company) became the Newport Bank’s third president in 1827 and served until 1834. He was a Revolutionary War veteran, having fought in the Battle of Rhode Island in 1778. Following his death, Samuel’s own son William (1788-1867) became the fourth president of the bank (his signature is on the $2 and $5 obsolete notes below).

John B. Shearman was the Newport Bank’s first cashier and served until 1828, when he was replaced by John Williams Jr. In 1832, Stephen Cahoone took over the position. Cahoone was also the General Treasurer of Rhode Island from 1840 to 1851.

Henry C. Stevens became cashier in 1852, at the age of 22. He had been working as a clerk at the bank since the age of 18. Stevens would stay in that position for the next 58 years! Upon his death in 1910, his son Henry C. Stevens, Jr. took over and stayed there until 1922.

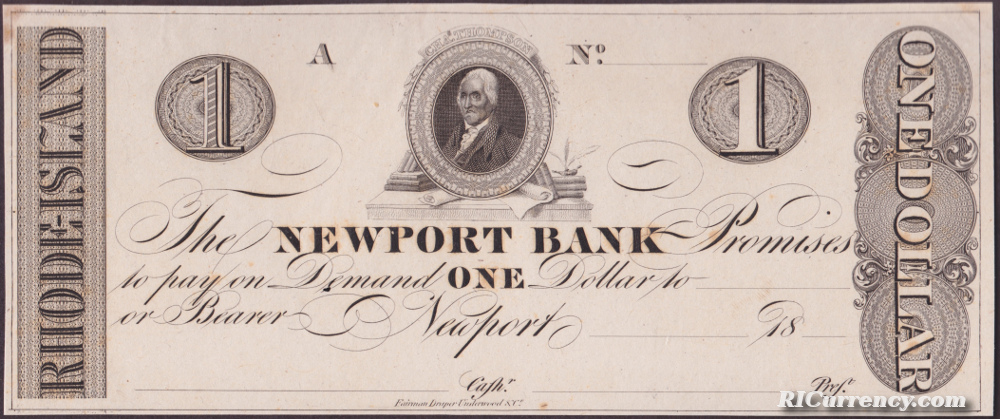

All but one of the issued genuine notes below bear a signature from a Stevens as cashier.

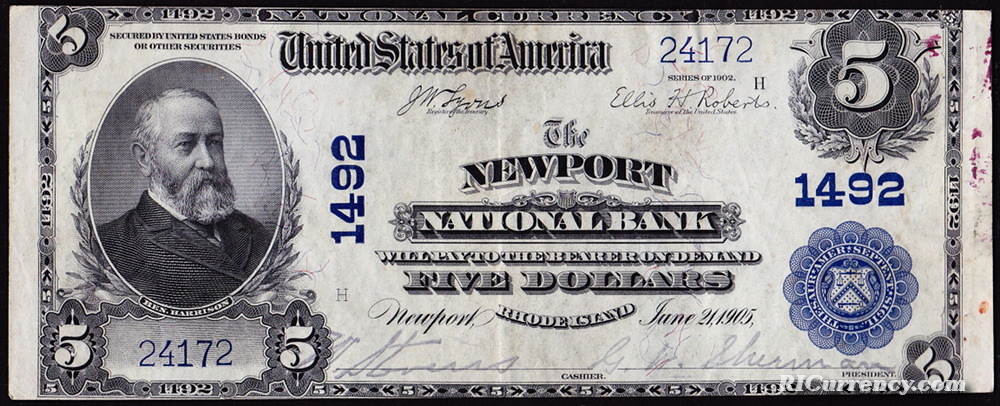

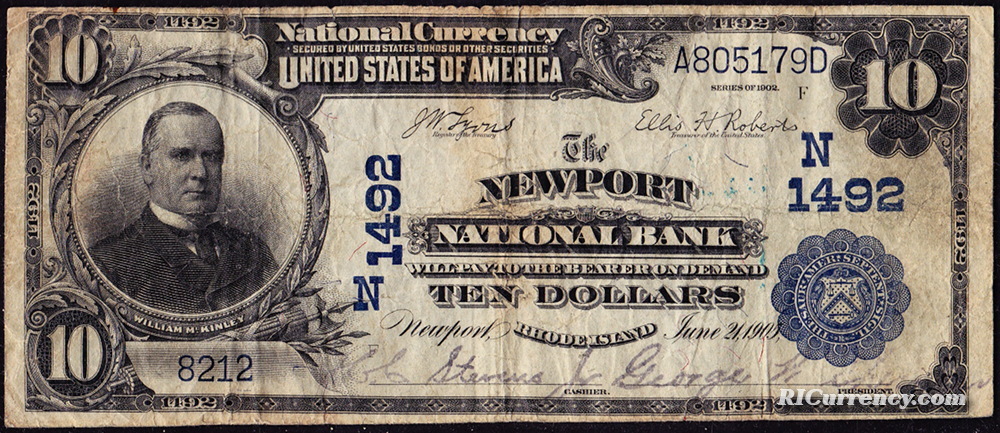

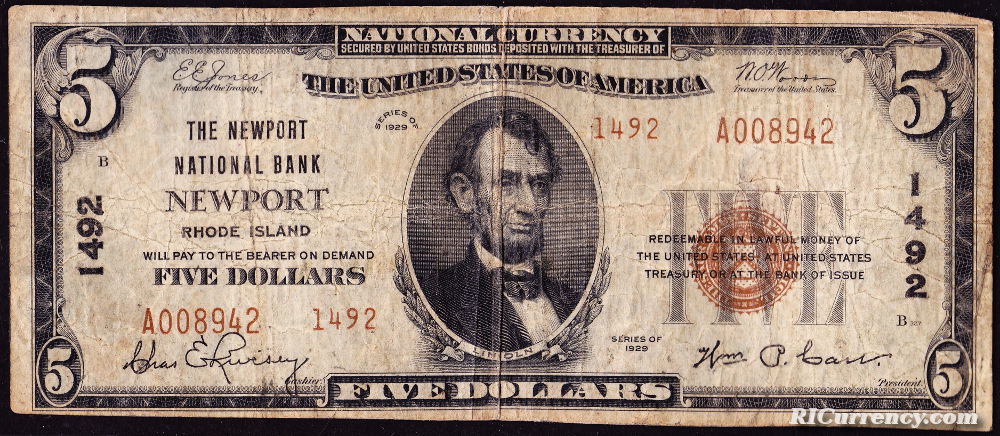

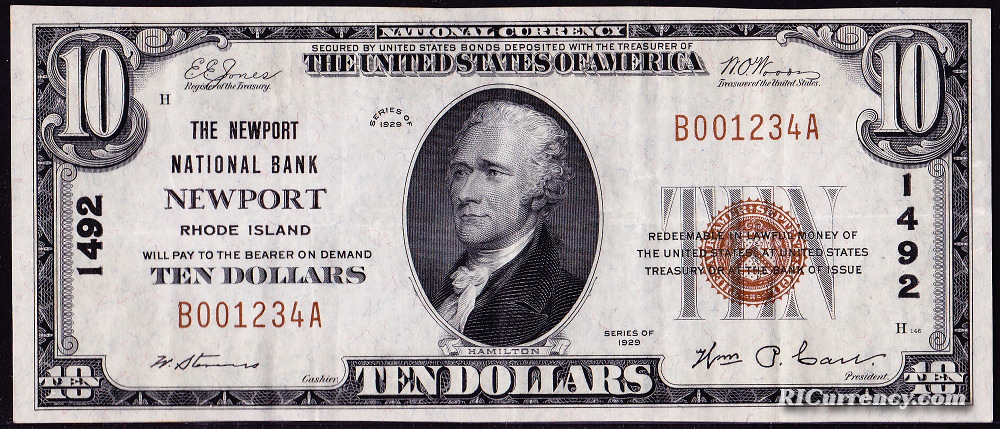

In 1865, the company became the Newport National Bank and was given charter #1492. Roger Durand, in his book on early Rhode Island paper money, notes that this charter number was fortuitous, as the bank often used the image of Christopher Columbus on its currency.

Newport National was subsequently acquired by Old Colony Co-Operative Bank of Providence in 1971, which in turn was bought by Bank of New England on March 25, 1986. In 1990, BNE sold its Old Colony assets to Citizens Bank of Providence. Today, the original Newport Bank offices in Washington Square serve as a Citizens Bank branch.

* One biography lists William’s son Samuel Vernon as the first president of the Newport Bank, but I have been unable to corroborate this.

** William Vernon died in December of 1806. In 1807, a ship owned by a William Vernon of Newport named the Mary made a voyage to the Kingdom of Loango (now the Congo). There, the captain purchased 199 slaves, 150 of whom survivied the 64-day crossing to Charlestown, South Carolina. It’s unclear whether this was a venture started by Vernon before his death, or something undertaken by a relative who had the same name. It’s also unclear what part, if any, this bank had in financing the voyage.

May 24, 1837. Durand 649, Haxby RI-160 S10, Bowers W-RI-550-002-S020

A 19th century photo of the Newport National Bank’s historic home on Washington Square. Also visible are the Ambrose Dining Rooms and Coggeshall’s Market.

© Newport Historical Society. Reprinted with permission.

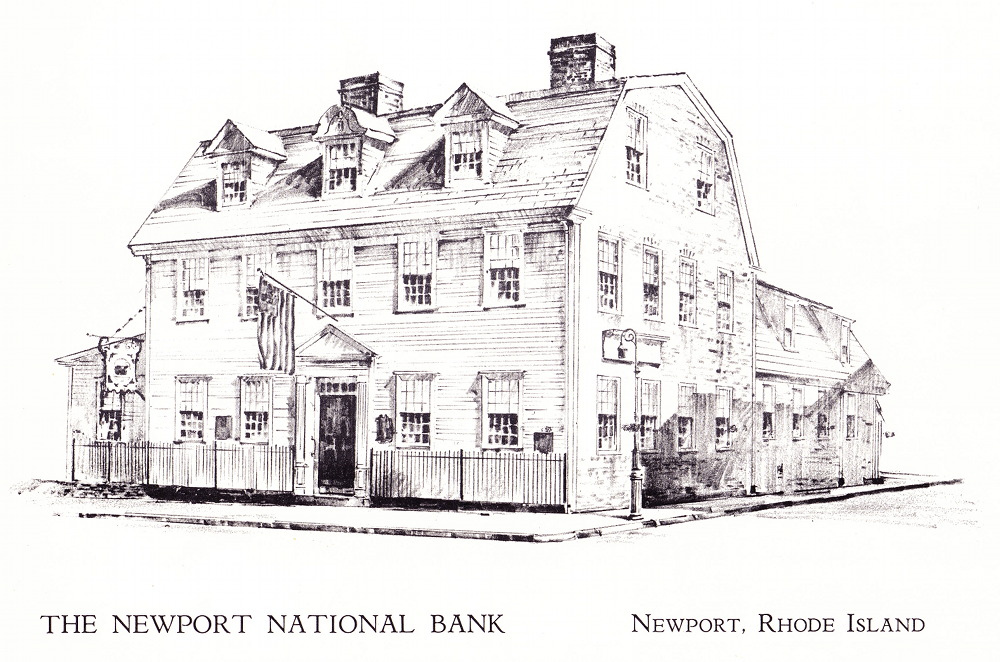

Vintage postcard showing the bank at left.

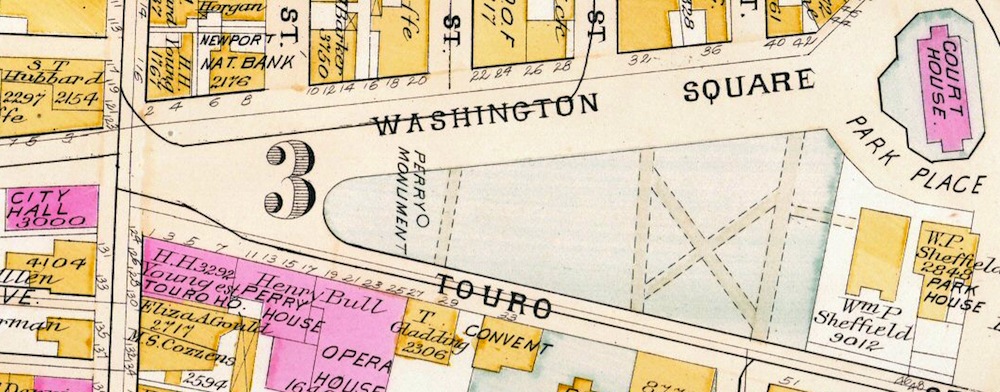

An 1893 map of Washington Square, showing the Newport National Bank in the center of the city’s civic life, in the upper left, at no. 8.

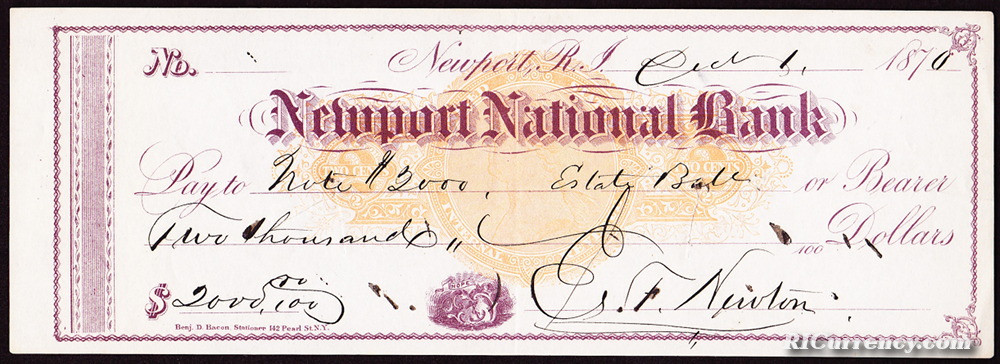

Bank check from October 1, 1870.

An image of the bank’s home from a 1969 calendar.

The Newport Bank’s original home, now a local branch of Citizens Bank.

Signage on the building today.

(